We invest in people and in the businesses they represent.

The Nordic region has a well-developed ecosystem for entrepreneurship and the realization of ideas. Many talented businessmen and women have created sound and well-run businesses. When the time comes for these individuals to take the next step – either to do something else or to invest in growth – this is where Salix Group comes in. We invest primarily in trading businesses and provide traction in the form of knowledge, commitment and capital.

We normally operate in the same or nearby market as our acquisition candidates, which means that we often have an investment hypothesis early in the process. Keywords for us are strong brands, strong market position and well-functioning organizations.

An efficient and proven process.

Selling one’s life work is not easy. On top of the emotional impact, selling is sometimes associated with a long, laborious process where the end result is uncertain and does not always conclude with a sale. With Salix Group as the buyer, the sales process is drastically shortened and simplified, and the likelihood of a positive conclusion also increases.

Many years in the industry has taught us the art of making successful acquisitions, integrating businesses, securing synergies and adding what is needed to achieve long-term success. Each possible acquisition begins with an initial evaluation. If we move forward, we follow an efficient process where the goal is to close the deal.

Acquisition process.

-

A reliable counterpart

We only start processes where the probability of the transaction being carried out is high.

-

Efficient process

With short decision paths, a committed board and internal knowledge, we offer short processes.

-

Experienced handling

With extensive experience in business acquisitions, we can handle complex transactions efficiently.

-

Well-managed finances

When a bid is submitted, there is usually already approval from the board and financing available.

With long-term value creation as our main focus.

Salix Group is looking for well-run businesses with leading market positions and strong cash flows. We are highly selective in our evaluation of new acquisitions – and apply the principle that it is better to risk losing a good deal than to risk implementing a bad deal. With this principle as the foundation for the selection process, a full evaluation is conducted using several acquisition criteria as guiding points.

- A track record of solid profitability.

- Strong cash flows.

- Tested and proven business model.

- Leading market position.

Case study.

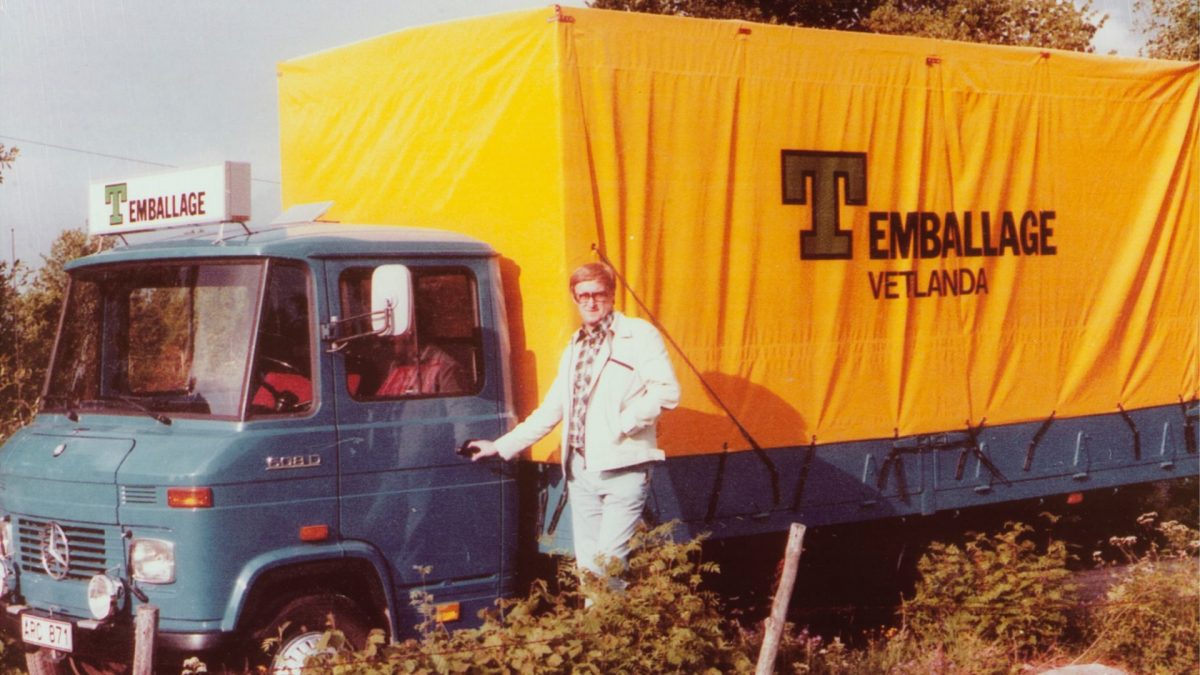

In November 2017, T-Emballage based in Vetlanda in Småland, Sweden, was acquired. Learn more about the acquisition process here. (In Swedish.)

Have you got what we are looking for?

We are constantly looking for new acquisitions. Are you interested in having a discussion with us about a potential company sale? Get in touch!

Don’t hesitate to contact Salix Group via investeringar@salixgroup.se